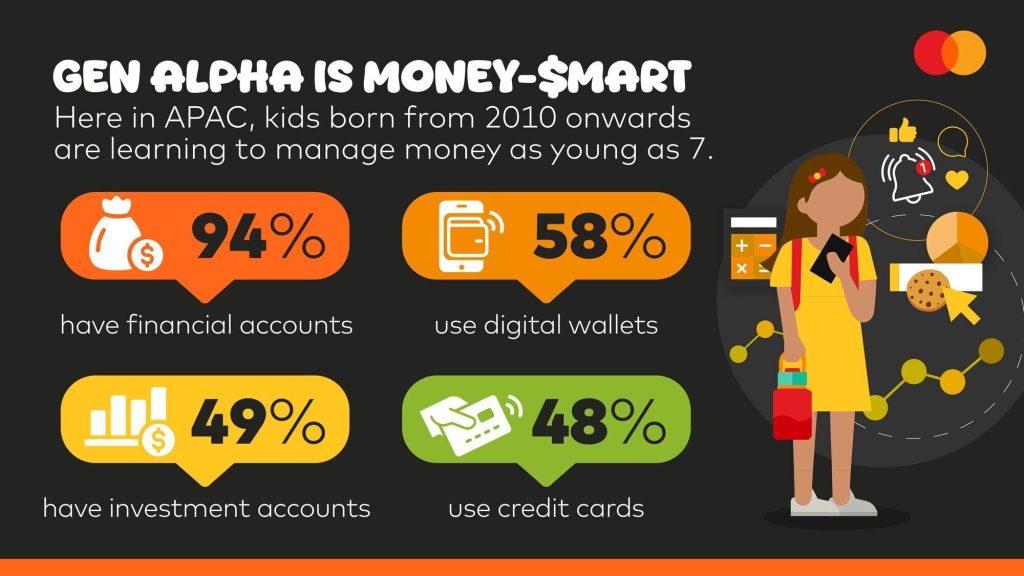

Malaysia’s Gen Alpha Is Redefining Financial Literacy in a Digital-First World, Mastercard Report Reveals. Malaysia’s youngest generation is rewriting the rules of financial literacy, embracing money management tools earlier than any generation before them. According to new findings from Mastercard, 97% of Malaysian Gen Alpha children (born in 2010 onwards) already have access to a financial account, while a significant proportion are using digital wallets (46%), investment accounts (40%), and debit cards (40%)—well before reaching adulthood. These digital natives are not only engaging with money at an early age, but they are also shaping the future of finance itself.

This generational shift is set against the backdrop of Malaysia’s growing digital economy. With one of the highest digital wallet penetration rates in Southeast Asia (about 40%), Gen Alpha is growing up expecting seamless, mobile-enabled payment experiences. Their early exposure to platforms like mobile wallets, QR codes, and biometric payment methods reflects a wider trend in the country: a culture increasingly comfortable with innovation and cashless transactions. As trends such as shoppertainment—which combines interactive content, AR/VR commerce, and real-time entertainment—become more popular, Gen Alpha is expected to favour brands and services that offer frictionless and immersive digital experiences.

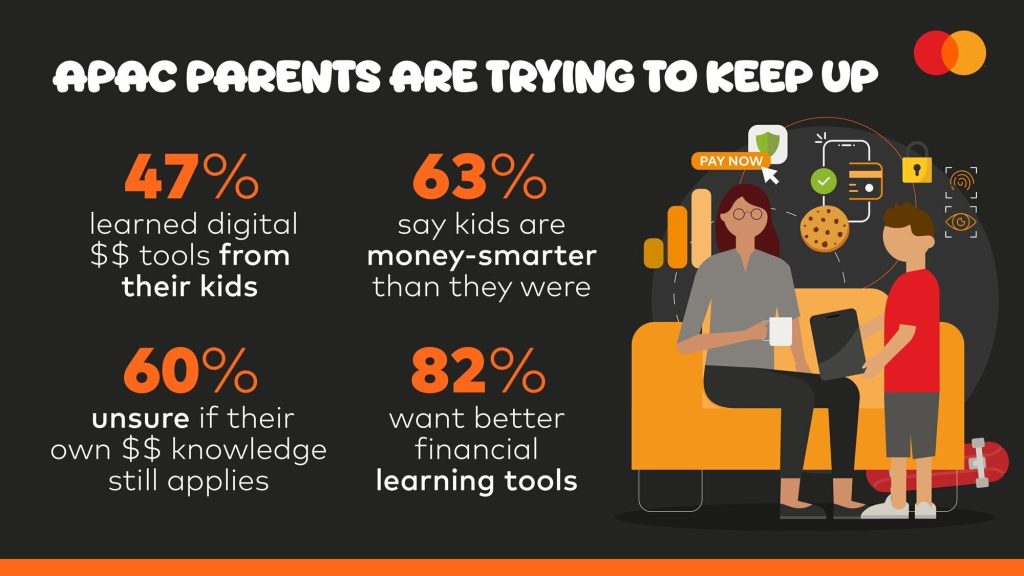

The Mastercard study also reveals that parents are taking note of their children’s digital savvy. Half of Malaysian parents believe their Gen Alpha children are more financially aware than they were at the same age, while 40% say their kids know more about modern payment methods than they do. However, while parents feel prepared to teach their children the basics of financial literacy, more advanced topics are proving to be a challenge. Over half (51%) feel that teaching kids about money is becoming increasingly complicated, and 54% question whether their financial knowledge remains relevant for today’s digital world. A vast majority—79%—express a desire for better tools to educate their children on managing finances.

This rising demand signals a clear opportunity for financial institutions to step in and develop future-ready financial tools. Malaysian parents are particularly interested in features like educational content and parental controls (73%), seamless account transfers (57%), real-world simulations (45%), and gamified learning experiences (42%) to help their children grasp financial concepts in an engaging and interactive way.

Beena Pothen, Country Manager for Malaysia & Brunei at Mastercard, highlighted how these findings showcase Malaysia’s digital leadership. “With 97% of Gen Alpha children already accessing financial accounts and nearly half using digital wallets, it’s clear they’re growing up with a strong digital-first mindset,” she said. “This is a true reflection of Malaysia’s impressive momentum in digital transformation. Mastercard is supporting this progress by driving innovation that delivers secure, seamless, and meaningful payment experiences—not just for Gen Alpha children, but for their parents as well.”

The report also confirms that Malaysia’s broader population is highly receptive to financial innovation. Among Gen Zs (72%) and Millennials (69%) in Malaysia, there’s a strong preference for modern payment methods such as Tap & Go, biometric verification, mobile wallets, and QR code payments over traditional cash or manual card entry. In fact, 63% of Malaysians across all age groups prefer new payment methods, compared to 53% in the Asia Pacific region, 25% in North America, and 24% in Europe—further reinforcing Malaysia’s role as a front-runner in financial innovation.

Conducted by The Harris Poll on behalf of Mastercard, the survey gathered insights from over 19,000 global consumers, including more than 1,000 respondents in Malaysia. The research sheds light on the evolving financial landscape and underscores the need for educational, technological, and institutional support to help Gen Alpha and their families thrive in a rapidly digitising world.

As Malaysia’s Gen Alpha continues to lead the way in early adoption and digital engagement, the future of financial literacy is no longer about waiting to grow up—it’s about growing up empowered.